Is a car title loan right for me? There are several factors to consider when deciding if a car title loan is the right option for you:

Credit Score: One of the main advantages of a car title loan is that they often do not require a credit check. This makes them an attractive option for individuals with poor or no credit history. However, it’s essential to remember that car title loans can come with high interest rates and fees, so it’s crucial to weigh the costs against the benefits.

-

Loan Amount and Repayment Terms: Car title loans are generally designed for short term financial needs and can provide a lump sum of money quickly. However, the amount you can borrow is limited to the value of your car, which may not be enough to cover your financial needs. Additionally, the repayment terms can be quite short, which may make it challenging to keep up with the payments if you’re unable to secure a lower interest rate.

-

Alternatives: Before considering a car title loan, it’s essential to explore other options such as personal loans, credit cards, or even borrowing from friends or family. These alternatives may have lower interest rates and more flexible repayment terms, making them a better choice for your financial situation.

-

Financial Situation: It’s essential to consider your overall financial situation when deciding whether a car title loan is right for you. If you’re already struggling to make ends meet, a car title loan could exacerbate your financial problems due to high interest rates and fees.

In conclusion, a car title loan may be a viable option for those with poor credit or an urgent need for cash. However, it’s essential to carefully consider the potential risks and explore alternative options before deciding if a car title loan is right for you.

If the Pro’s outweigh the Con’s, Get started now!

Understanding Car Title Loans

A car title loan, often known as a “pink slip loan,” is a type of secured loan where borrowers can use their vehicle title as collateral. This means that the lender places a lien on the car’s title, and the borrower temporarily surrenders the hard copy of the vehicle title, in exchange for a loan amount. When the loan is fully repaid, the lien is removed and the car title is returned to its owner. However, if the borrower defaults on their loan, the lender may repossess the vehicle and sell it to recoup their money.

The process of obtaining a car title loan is typically fast and does not require a credit check, which makes it an attractive option for individuals who need cash quickly and may have bad credit. The loan amount is usually determined by the value of the car, which means that the more the car is worth, the more money a borrower can potentially receive. However, it’s important to note that most lenders will only lend a fraction of the car’s actual market value.

To qualify for a car title loan, borrowers must own their vehicle outright and have a lien free car title. Some lenders also require proof of income, a valid photo ID, and sometimes even proof of insurance. Once these requirements are met, the loan can often be approved in a matter of minutes, with the funds being deposited into the borrower’s bank account or made available as cash.

The convenience of car title loans comes at a cost, typically in the form of high interest rates and additional fees. The annual percentage rate (APR) can be as high as 300%, which can make repayment a significant challenge for many borrowers. This is why it’s crucial to understand the full terms and conditions of the loan, including the interest rate, repayment schedule, and any potential penalties for late or missed payments.

Despite the risks associated with high costs and the potential for vehicle repossession, car title loans remain a popular choice for individuals facing emergency expenses or those in urgent need of cash. It’s a financial tool that can provide immediate relief in times of financial distress, but it requires careful consideration and responsible use to avoid long term financial repercussions.

Assessing Your Financial Situation

Before you consider applying for a car title loan, it’s imperative to take a thorough look at your financial situation. This assessment is not just a responsible step towards borrowing; it’s a necessary one to ensure that the decision to borrow money won’t exacerbate your financial challenges. Start by reviewing your monthly income and expenses to determine how much you can realistically afford to repay without compromising your budget. It’s also crucial to consider the full cost of the loan, which includes not only the principal amount but also the interest and any additional fees that may apply.

Understanding your credit score is another important aspect of evaluating your financial health. While car title loans typically don’t require a credit check, having a good credit score could open up alternative solutions with more favorable terms. It’s also beneficial to explore your debt to income ratio, as this will give you a clearer picture of your current debt obligations and how a new loan would fit into that scenario. If you’re already struggling with debt, adding a high interest loan to the mix might not be the wisest course of action.

It’s also wise to consider the potential long term effects of taking out a car title loan. For instance, if you’re unable to repay the loan, you risk losing your vehicle, which could have a domino effect on your ability to work or manage other responsibilities. Therefore, it’s essential to have a solid repayment plan in place before you proceed. This might involve cutting back on non essential expenses, finding additional sources of income, or even consulting with a financial advisor to help you navigate your options.

Remember, a car title loan should not be a go to solution for every financial hiccup. Instead, it should be reserved for situations where you have an urgent need for cash and have exhausted all other reasonable options. By taking the time to assess your financial situation thoroughly, you can make an informed decision that aligns with your personal finance goals and ensures that you’re not putting yourself in a position that could lead to further financial distress.

The Pros and Cons of Car Title Loans

Car title loans can be a double edged sword, offering immediate financial relief but also carrying significant risks. On the positive side, one of the most compelling advantages of car title loans is the ability to access fast cash. For those in an urgent need of funds due to emergency expenses, car title loans can provide a lump sum of money in a short period, often on the same day of application. This quick turnaround can be a lifeline when time is of the essence and other financial avenues have been exhausted or are not available due to a borrower’s credit score or financial history.

However, the convenience of quick cash comes with considerable drawbacks. High interest rates are a hallmark of car title loans, with average APRs that can soar well into triple digits. This can make repayment significantly more challenging, as the cost of the loan escalates rapidly over time. Additionally, the short repayment period, often 30 days, can create a cycle of debt for borrowers who are unable to repay the loan in one lump sum and may need to take out additional loans to cover the initial debt.

The risk of vehicle repossession is another serious concern. Since the car serves as collateral, failure to repay the loan can result in the lender taking possession of the vehicle. This not only means the loss of transportation, which can affect a person’s ability to work and manage daily responsibilities, but also the loss of the vehicle’s value, which is often higher than the loan amount received. It’s a scenario that can have long term negative impacts on a person’s financial situation and mobility.

It’s also important to note that while car title loans do not typically require a credit check, this can be a disadvantage in disguise. Without the need to assess a borrower’s ability to repay, lenders may extend loans to individuals who are more likely to default, further exacerbating their financial difficulties. This practice raises concerns about responsible lending and the need for borrowers to be fully aware of the terms and conditions of the loan they are considering.

| Pros | Cons |

|---|---|

| Quick access to cash | High interest rates |

| No credit check required | Short repayment period |

| Loan amount based on vehicle value | Risk of vehicle repossession |

| Convenient for emergency expenses | Potential for debt cycle |

Again, if the Pro’s outweigh the Con’s get started today!

Alternative Solutions to Car Title Loans

If you’re contemplating a car title loan to meet your financial needs, it’s crucial to consider alternative solutions that may offer more favorable terms and less risk. Personal loans, for instance, can be a viable option, especially if you have a good credit score. Unlike car title loans, personal loans are unsecured, meaning they don’t require collateral, and they often come with lower interest rates and longer repayment periods. This can make them a more manageable and cost effective borrowing option in the long run.

Payday alternative loans (PALs) offered by federal credit unions are another option worth exploring. These loans are designed to provide members with a small amount of cash for a short period, without the high fees and interest rates associated with traditional payday loans. To be eligible for a PAL, you typically need to be a member of the credit union for a certain period. The National Credit Union Administration (NCUA) regulates these loans, capping the interest rate at 28%, which is significantly lower than the triple digit APRs that can accompany car title loans.

Debt consolidation is an additional strategy that can help streamline your finances by combining multiple debts into a single loan with a lower interest rate. This can simplify your monthly payments and potentially reduce the amount of interest you pay over time. However, it’s important to carefully evaluate the terms of a consolidation loan to ensure that it truly offers a financial advantage and doesn’t just extend the debt period.

Each of these alternatives comes with its own set of requirements and considerations. Personal loans may require a credit check and proof of ability to repay, while PALs are limited to credit union members and may have borrowing limits. Debt consolidation requires a careful assessment of your existing debts and the consolidation loan’s terms. It’s essential to weigh these options against your current financial situation and long term financial goals to determine the best course of action.

| Loan Type | Interest Rate | Repayment Period | Collateral Required |

|---|---|---|---|

| Personal Loan | Varies (typically lower than title loans) | Varies (usually longer than title loans) | No |

| Payday Alternative Loan (PAL) | Capped at 28% by NCUA | 1 to 12 months | No |

| Debt Consolidation Loan | Varies (potentially lower than original debts) | Varies | Depends on the lender |

How Car Title Loans Compare to Other Short Term Loans

When you’re in a financial pinch, it’s important to understand how car title loans stack up against other short-term lending options. Payday loans, pawnshop loans, and credit card cash advances are common alternatives, each with their own set of terms and conditions. Payday loans are often considered when a small amount of cash is needed quickly, but they come with extremely high interest rates and a requirement to repay the loan by your next paycheck, which can lead to a cycle of debt if not managed properly.

Pawnshop loans, on the other hand, require you to put up a valuable item as collateral, with the loan amount based on a percentage of the item’s value. While the interest rates for pawnshop loans are typically lower than those for payday or title loans, the risk of losing your property if you cannot repay the loan remains a significant downside. Credit card cash advances provide immediate access to funds up to a certain limit and are convenient if you already have an open line of credit. However, they come with high fees and interest rates that start accruing immediately, unlike purchases that may have a grace period.

Car title loans differ from these options primarily in the loan amount, which can be higher since it’s based on the value of your vehicle. However, this also means that you risk losing a more substantial asset your car – which can have far reaching consequences on your ability to commute and earn a living. It’s essential to compare the interest rates, fees, and repayment terms of these short term loans to make an informed decision that won’t jeopardize your financial health.

| Loan Type | Interest Rates | Repayment Period | Fees | Collateral |

|---|---|---|---|---|

| Car Title Loan | High (up to 300% APR) | Short (usually 30 days) | High (including processing and document fees) | Vehicle |

| Payday Loan | Extremely High (up to 400% APR) | Very Short (until next paycheck) | High (including origination fees) | None |

| Pawnshop Loan | Moderate to High | Short (usually 30 to 90 days) | Moderate (including storage and insurance fees) | Personal Property |

| Credit Card Cash Advance | High | Flexible (until paid in full) | High (including cash advance fees) | None |

The True Cost of a Car Title Loan

The allure of quick access to cash can often overshadow the true cost of a car title loan. It’s not just the principal amount you borrow; the real cost includes soaring interest rates, compounded fees, and other charges that can make these loans far more expensive than they may appear at first glance. The average annual percentage rate (APR) for car title loans can be as high as 300%, which is significantly higher than most other forms of credit. This means that on a loan of $1,000, you could end up paying $3,000 over the course of a year if the loan remains unpaid, turning what seemed like a lifeline into a financial burden.

In addition to the exorbitant interest rates, car title loans often come with a host of fees. Document fees, processing fees, and even roadside service plan fees are just a few examples of the additional costs that can be tacked onto the loan. These fees can add up quickly, increasing the total cost of the loan and making it even more difficult to repay. It’s not uncommon for borrowers to find themselves in a situation where the fees and interest exceed the actual loan amount, trapping them in a cycle of debt that can be hard to escape.

It’s also important to consider the repayment period when calculating the true cost of a car title loan. Most lenders require the loan to be repaid in one lump sum, typically within 30 days. If you’re unable to meet this deadline, you may be offered the option to roll over the loan into a new one, which comes with additional fees and interest, further inflating the cost. This cycle can continue, with each rollover bringing you deeper into debt.

To fully understand the financial implications of a car title loan, it’s essential to read the fine print and ask the lender to disclose all fees and charges upfront. By doing so, you can make an informed decision and avoid any surprises down the line. Below is a breakdown of the potential costs associated with a car title loan, illustrating just how quickly the expenses can add up.

| Cost Type | Description | Potential Amount |

|---|---|---|

| Interest Rate | Annual percentage rate applied to the loan | Up to 300% APR |

| Document Fees | Charges for processing paperwork | $25 – $100 |

| Processing Fees | Fees for loan origination and administration | $50 – $200 |

| Late Payment Fees | Charges for payments made past the due date | Varies by lender |

| Roadside Service Plan Fees | Optional service offered by some lenders | $50 – $100 |

| Repossession Fees | Costs associated with vehicle repossession if the loan is not repaid | $300 – $500 |

The Application Process for a Car Title Loan

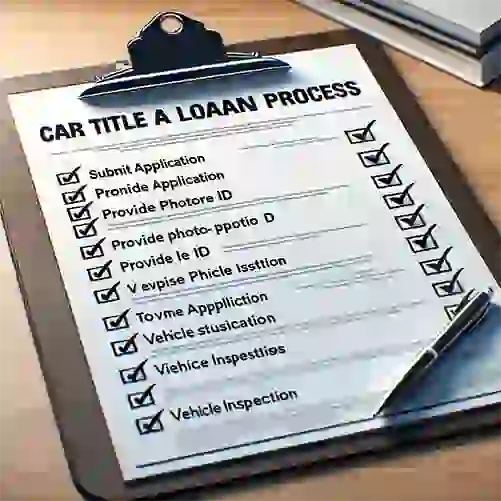

Applying for a car title loan might seem straightforward, but it’s a process that requires careful attention to detail to ensure you understand what you’re agreeing to. The following step by step guide will walk you through the application process, from start to finish, to help you navigate the complexities and make informed decisions.

- Assess Your Need: Before you begin, consider whether a car title loan is the best solution for your financial situation. Explore other options and only proceed if it’s absolutely necessary.

- Check Your Eligibility: Ensure you meet the basic requirements: you must own your vehicle outright, have a lien free car title, and often need to provide proof of income.

- Gather Required Documents: Collect all necessary documents, including your vehicle’s title, government issued photo ID, proof of insurance, and any additional paperwork the lender may require.

- Find a Reputable Lender: Research lenders to find one that offers fair terms and transparency. Check their license and read reviews from other borrowers.

- Understand the Terms: Read the fine print carefully. Pay special attention to the interest rate, repayment schedule, and any fees associated with the loan.

- Submit Your Application: Fill out the application form, either online or in person, and submit it along with all required documents.

- Vehicle Inspection: The lender will need to inspect your vehicle to determine its value, which will influence the loan amount you’re eligible for.

- Sign the Agreement: If approved, review the loan agreement one final time before signing. Make sure you understand all the obligations and repercussions of non payment.

- Receive Funds: Once the agreement is signed, the lender will issue the loan. The funds can be provided as cash or deposited directly into your bank account.

Throughout the application process, it’s vital to ask questions and clarify any points of confusion. Remember, once you sign the loan agreement, you’re legally bound to its terms. The speed and ease with which you can receive funds should not overshadow the importance of understanding the full commitment you’re making.

Budget Planning and Repayment Strategies

Successfully managing a car title loan requires meticulous budget planning and the implementation of strategic repayment methods. The goal is to fulfill your loan obligations without succumbing to a perpetual cycle of debt. To start, create a comprehensive budget that details your monthly income and expenses. This will help you identify areas where you can cut back and allocate funds toward repaying the loan. Prioritize your spending, ensuring that essentials like housing, food, and the loan repayment are covered first.

One effective strategy is to break down your loan repayment into smaller, more manageable amounts. Instead of waiting until the due date to pay back the entire sum, consider making weekly or bi weekly payments. This can reduce the burden of a large one time payment and may even decrease the amount of interest accrued, as some lenders calculate interest on a daily basis.

Another tactic is to explore additional sources of income. This could involve taking on extra work, selling items you no longer need, or finding creative ways to generate revenue. Every extra dollar can be directed toward your loan repayment, potentially shortening the loan term and reducing the overall interest paid.

It’s also wise to establish an emergency fund, even if it’s a small one, to avoid needing another car title loan in the future. Start by setting aside a modest amount from each paycheck, gradually building a financial cushion that can help you handle unexpected expenses without resorting to high interest loans.

If you find yourself struggling to repay the loan, communicate with your lender immediately. Many lenders are willing to discuss alternative payment plans or extensions that can prevent default. However, be aware that this may come with additional fees and interest, so it’s crucial to understand the terms of any modified repayment agreement.

Remember, the key to avoiding a debt trap is to stay proactive with your finances. Regularly review and adjust your budget, keep an open line of communication with your lender, and always look for ways to improve your financial stability. By doing so, you can navigate the challenges of a car title loan and emerge with your finances intact.

Seeking Advice from a Financial Advisor

Navigating the complexities of a car title loan can be daunting, and making an informed decision requires a clear understanding of the financial implications. This is where the expertise of a financial advisor or a credit union member representative becomes invaluable. Consulting with a professional can provide you with personalized advice tailored to your unique financial situation. They can help you assess the potential risks and benefits of a car title loan, explore alternative financing options, and develop a repayment strategy that aligns with your financial goals.

A financial advisor can also assist you in understanding the long term impact of taking out a car title loan, such as how it may affect your credit score, debt to income ratio, and overall financial health. They can offer insights into responsible borrowing practices and help you decipher the terms and conditions of the loan agreement, ensuring that you are fully aware of any fees, interest rates, and the total cost of the loan.

If you are a member of a credit union, you may have access to additional resources and support. Credit union member representatives are often well versed in the financial products and services available to their members, including payday alternative loans (PALs) that may offer more favorable terms than a car title loan. They can guide you through the application process for these alternatives and advise you on the best course of action based on your financial needs.

The decision to take out a car title loan should not be made lightly, and seeking professional advice is a crucial step in ensuring that you are making a choice that won’t jeopardize your financial future. Whether it’s to confirm that a car title loan is your best option or to help you find a less risky solution, a financial advisor can be an indispensable ally in your financial journey.

What to Do If You Can’t Repay the Loan

The reality of taking out a car title loan is that sometimes, despite best intentions and careful planning, you may find yourself unable to repay the loan. This situation is fraught with serious consequences, including the possibility of your vehicle being repossessed and sold by the lender. Such an outcome not only deprives you of your transportation but can also have a lasting negative impact on your credit score and financial stability.

If you’re facing difficulties with repayment, it’s critical to act swiftly. The first step is to communicate with your lender as soon as you realize you might miss a payment. Many lenders are willing to work with borrowers to find a solution, which could include refinancing the loan or restructuring the repayment terms. Refinancing may provide you with a lower interest rate or extend the loan term to reduce the monthly payment amount. However, be aware that this could also mean paying more in interest over the life of the loan.

Negotiating a new payment plan is another option. Some lenders may agree to modify the original terms of the loan to help you manage the payments more effectively. This could involve extending the loan period, which would lower the amount you pay each month, although it may increase the total interest paid. It’s essential to understand the new terms completely and ensure that the revised plan is sustainable for your financial situation.

In some cases, seeking assistance from a nonprofit credit counseling organization can be beneficial. These organizations can offer guidance on managing debt and may help you negotiate with the lender. They can also provide resources and tools for budgeting and financial planning to prevent similar situations in the future.

It’s important to remember that ignoring the problem will not make it go away and can lead to more severe consequences, such as legal action against you or the loss of your vehicle. Taking proactive steps to address the issue can help you find a resolution and avoid the most severe repercussions of defaulting on a car title loan.

Responsible Lending and Borrowing Practices

The dynamics of car title loans involve not just the borrower but also the lender, and it is crucial for both parties to engage in responsible practices. Responsible lending involves title lenders providing clear and transparent information about the terms of the loan, including the interest rate, fees, and the repayment schedule. Lenders should also assess the borrower’s ability to repay the loan, a practice that helps prevent the borrower from becoming entrapped in a cycle of debt. Ethical lenders will avoid predatory practices such as hidden fees, misleading terms, and aggressive collection tactics.

On the flip side, responsible borrowing is equally important. As a car owner considering a title loan, you should ensure that you fully understand the terms of the loan and are confident in your ability to repay it within the agreed period. This includes being aware of the APR, all associated fees, and the potential consequences of non repayment. Borrowers should also avoid borrowing more than is necessary or taking out a loan as a short term solution to a long term financial problem.

Both lenders and borrowers can benefit from adhering to responsible lending and borrowing practices. For lenders, it means building a reputation for fairness and integrity, which can lead to a more loyal customer base and fewer defaults. For borrowers, it means maintaining control over their financial situation and avoiding the severe consequences that come with defaulting on a loan.

It is also beneficial for borrowers to seek out lenders who are members of reputable industry associations that promote responsible lending practices. These associations often have codes of conduct and standards that their members must adhere to, providing an additional layer of protection for borrowers.

Making an Informed Decision

Deciding whether a car title loan is the right choice for your financial needs is a significant decision that requires careful consideration. To make an informed decision, it’s essential to review the key points discussed throughout this guide. Consider the urgency of your need for cash and weigh it against the high interest rates and fees associated with car title loans. Reflect on the potential risks, such as the possibility of vehicle repossession and the impact on your personal finance should you be unable to repay the loan.

Evaluate alternative solutions that may offer more favorable terms, such as personal loans, payday alternative loans from federal credit unions, or debt consolidation options. Assess your financial situation thoroughly, including your ability to repay the loan without compromising your budget or falling into a debt trap. If you decide to proceed with a car title loan, ensure that you understand all the terms and conditions, and have a solid repayment strategy in place.

Consulting with a financial advisor can provide valuable insights and help you explore all available options. Remember that responsible borrowing is key to maintaining financial health, and it’s important to borrow only what you need and are capable of repaying. By taking all these factors into account, you can make a decision that not only addresses your immediate financial needs but also safeguards your long term financial well being.

Is a car title loan right for me? The alternative to a payday loan!

Jer is a Consultant & go-to guy for startups and founders. Expert with both Online and storefront B2C lending strategies. Jer at Trihouse Consulting is your Co-Founder, consultant, investor... Start-ups in installment, payday loan, car title lending, line of credit... Storefront to Online transition is my specialty. Focused on operations, marketing, Internet models, tribe, brick-n-mortar development, website development, regulatory & compliance, and State and Tribe licensed lending models. Banking, ODFI, ACH, ICL, Debit, Credit.

TrihouseConsulting@gmail.com 702-208-6736 (PDT)

Linked In profile

Mentioned in Digital Groth

Clarity FM

Trihouse Consulting

How to start a payday loan

zoom info

Startups.com

IWV Pro

Leaning Rock Finance

payday and paycheck loans

Automobile Pawn

Quora

Medium

RocketReach