Pawn Car Title: How to Secure a Loan Quickly Using Your Vehicle

Title pawning offers a quick and convenient way for vehicle owners to secure a loan by using their car title as collateral. Unlike traditional loans from banks or credit unions, title pawns are designed to be short term financial solutions where the borrower allows the lender to place a lien on their vehicle title in exchange for a loan amount. Typically, borrowers continue to possess and use their vehicle while the loan is being repaid, although the lender holds onto the physical title as security for the loan. The process generally requires minimal bureaucracy and can provide funds more rapidly than most conventional lending methods, sometimes in as little as thirty minutes. However, it is paramount for individuals considering this option to understand the eligibility requirements, the repayment process, and the financial considerations involved. High interest rates and additional fees can make title pawning an expensive choice, and failure to repay the loan can lead to repossession of the vehicle.

The process generally requires minimal bureaucracy and can provide funds more rapidly than most conventional lending methods, sometimes in as little as thirty minutes. However, it is paramount for individuals considering this option to understand the eligibility requirements, the repayment process, and the financial considerations involved. High interest rates and additional fees can make title pawning an expensive choice, and failure to repay the loan can lead to repossession of the vehicle.Key Takeaways

- Title pawning is a method of obtaining quick funds by using a vehicle title as collateral for a loan.

- Borrowers usually retain their vehicles during the loan repayment period but must adhere to strict repayment terms to avoid repossession.

- Understanding the financial implications and consumer rights is essential when engaging in a title pawn transaction.

Understanding Pawn Car Title

When one needs quick access to funds, a pawn car title can be a viable option, leveraging a vehicle as collateral. Below, the intricacies of this process and the legal stipulations are examined to offer clarity.

When one needs quick access to funds, a pawn car title can be a viable option, leveraging a vehicle as collateral. Below, the intricacies of this process and the legal stipulations are examined to offer clarity.

Concept of Pawn Car Title

The concept of pawn car title, known also as a title pawn or a title loan, involves a vehicle owner using their vehicle’s title as collateral to secure a short term loan. The owner retains possession of the vehicle while the lender holds onto the title. Loans under this arrangement typically cater to individuals requiring immediate cash, accommodating even those with less rigorous credit score requirements. One critical point is that the loan amounts are usually predicated on the vehicle’s value.Legal Aspects of Pawning a Car Title

When it comes to legal aspects of pawning a car title, regulations vary by state. However, universally, borrowers must own the car outright, with a lien free title that lists them as the legal owner. Most lenders also require proof of income and government issued identification to secure the loan. It’s important to note that title pawns often involve high interest rates and have the potential for repossession if the borrower defaults on the loan. Therefore, understanding the terms and conditions laid out in the loan agreement is essential for compliance and avoids possible legal entanglements.Eligibility and Requirements for Pawning a Car Title

Pawning a car title allows individuals to secure a short term loan by using their vehicle’s title as collateral. Meeting the qualification criteria and presenting the required documents are critical steps in this process.

Pawning a car title allows individuals to secure a short term loan by using their vehicle’s title as collateral. Meeting the qualification criteria and presenting the required documents are critical steps in this process.

Qualification Criteria

- Ownership: The borrower must own the car outright, with no existing liens or other title loans against it.

- Vehicle Equity: There should be adequate equity in the car, meaning the vehicle’s current market value is more than any outstanding debts on it.

- Ability to Repay: The lender must be convinced of the borrower’s ability to repay the loan. This is often shown through proof of steady income.

Required Documents

- Vehicle Title: A clear vehicle title, which means it is free of any liens, is absolutely necessary.

- Valid Identification: A government issued ID, such as a driver’s license, is required to confirm the borrower’s identity.

- Proof of Income: Documentation such as pay stubs, Social Security statements, or pension receipts serve as proof that the borrower has a reliable source of income.

- Proof of Residence: Some lenders may also require a document that shows proof of residence, like a utility bill or lease agreement.

The Pawn Car Title Process

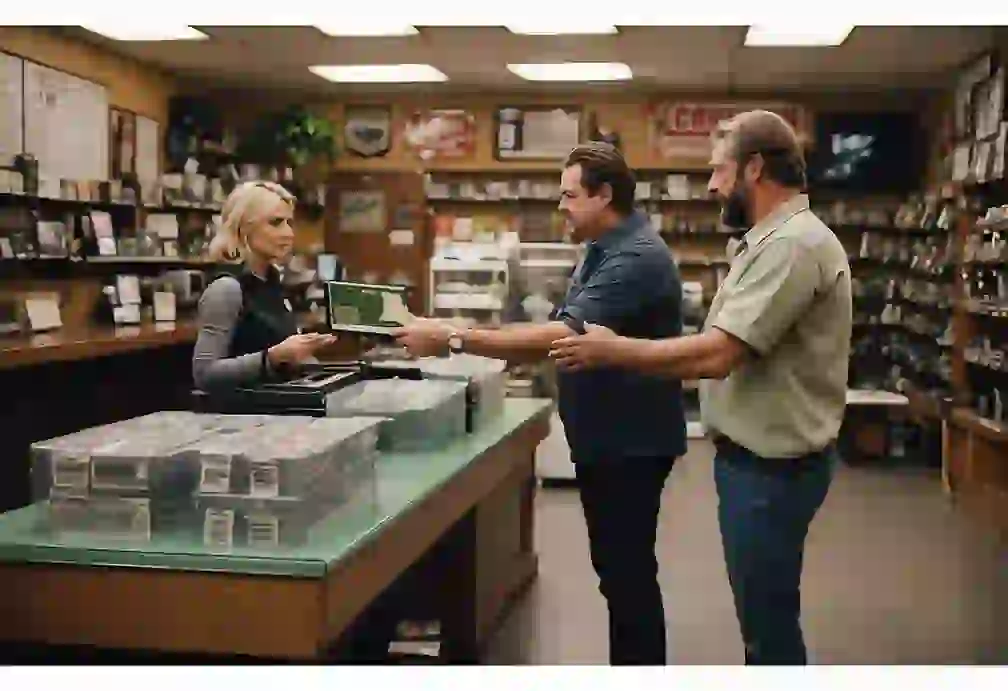

The pawn car title process allows a car owner to secure a loan using their vehicle as collateral. This process requires a clear assessment of the vehicle’s value, agreement on the loan terms, and understanding the legal contract involved.

The pawn car title process allows a car owner to secure a loan using their vehicle as collateral. This process requires a clear assessment of the vehicle’s value, agreement on the loan terms, and understanding the legal contract involved.

Evaluation of the Vehicle

The process begins with the evaluation of the vehicle. The borrower brings their car to the lender for a thorough inspection. The lender evaluates the car’s condition, make, model, year, and mileage to determine its current market value. It’s vital that the car be owned outright by the borrower and not encumbered by any existing liens.Appraisal and Loan Terms

Upon successful appraisal of the vehicle, the lender offers a loan amount that represents a percentage of the vehicle’s value. The loan terms, including interest rates, repayment schedule, and loan duration, are then discussed. These terms are contingent on several factors, such as the borrower’s ability to repay the loan and the lender’s policies.Contract and Conditions

If both parties agree, a contract outlining the details of the pawn arrangement is drafted. This includes conditions such as the borrower’s obligation to maintain insurance on the vehicle, the process for repossession should the borrower default, and any other lender specific conditions. Both parties must review and understand the contract before signing to ensure transparency and prevent future disputes.Financial Considerations

When considering a title pawn, it is critical to understand the financial obligations entailed. This includes accurate Loan Amount Estimation, evaluating Interest Rates and Fees, and comprehending Repayment Terms.Loan Amount Estimation

The amount one can borrow through title pawning directly correlates with the vehicle’s wholesale value. Agencies appraise the vehicle and typically offer a loan amount ranging from 25% to 50% of the car’s current market value.Interest Rates and Fees

Interest rates for car title loans are known for being substantially higher than other lending forms. They can exceed 300% APR, with additional fees for processing, document preparation, and late payments. Due diligence is required to identify the true cost of borrowing.Repayment Terms

Car title loans are typically short term, with repayment periods ranging from 15 to 30 days. Longer repayment schedules may be available, but it’s imperative to be aware that extended terms can significantly increase the overall interest paid on the principal loan amount.Get lender approval in as fast as 5 minutes

Risks and Benefits

Pawning a car title can be a quick way to secure a loan, but it comes with distinct risks and advantages that borrowers should carefully consider.Advantages of Pawning a Car Title

- Quick Cash: Pawning a car title allows individuals to access fast funding without the long approval processes of traditional banks.

- No Credit Check: These loans typically do not require a credit check, offering an option for those with poor or no credit.

Potential Risks and Disadvantages

- High Interest Rates: Car title loans often come with exorbitantly high interest rates, which can trap borrowers in a cycle of debt.

- Risk of Repossession: Failure to repay the loan can lead to the repossession of the vehicle, which can be disastrous for those dependent on their car for transportation.

Regulatory Compliance and Pawn Shops

In the pawn industry, rigorous adherence to federal and state laws is paramount. Ensuing compliance safeguards both the business and consumer interests.State Regulations and Compliance

Each state mandates varying statutory requirements for pawnshops which often include licensing applications, operational standards, and periodic inspections. For example, in Alabama, shops adhere to provisions detailed in the Alabama Pawn Shop Act, with state level oversight to ensure pawn shops maintain compliance with loan stipulations and other regulatory measures.Shop Selection Criteria

When selecting a pawnshop for a car title loan, consumers should verify the shop’s compliance with both federal consumer protection laws and applicable state regulations. Shops must ensure transparent disclosure of interest rates, loan terms, and redemption procedures. It is beneficial for potential borrowers to review a pawnshop’s standing with regulatory bodies such as the Federal Trade Commission for reassurance of legitimate and fair operations.Consumer Rights and Protections

When individuals use their car title for a loan, they are entitled to certain rights and protections under consumer law. Here are key points borrowers should be aware of:- Truth in Lending Act (TILA): Lenders are required to disclose the costs and terms of the loan, which includes the annual percentage rate (APR), finance charges, and payment schedule before the borrower enters the agreement.

- Right to Rescind: Consumers often have a short period, typically up to three days, to cancel the loan agreement without penalty or additional charges.

- Fair Debt Collection Practices Act (FDCPA): This act prohibits debt collectors from using abusive, deceptive, and unfair practices. It ensures that borrowers are treated with respect and dignity.

| Protection | Description |

|---|---|

| TILA Protections | Full disclosure of loan terms and costs. |

| Rescission Period | A short period to cancel the loan without penalty. |

| FDCPA Protections | Protection from abusive debt collection practices. |

Maintaining Vehicle Condition During the Pawn Period

When an individual pawns their car title, they must ensure their vehicle remains in good condition during the pawn period. This is crucial because the condition of the car can significantly impact its value, and consequently, the amount of money the owner may owe or recover.Regular Maintenance: It is advised that borrowers adhere to a routine maintenance schedule for their vehicle. This includes:- Oil Changes: Every 3,000 to 5,000 miles

- Tire Pressure Checks: Monthly

- Fluid Level Inspections: Coolant, brake fluid, and transmission fluid should be checked and topped off as needed.

- The exterior should be washed regularly to prevent rust.

- The interior should be vacuumed and wiped down to avoid stains and odors.

Ownership and Retrieval of Title

In the realm of car title pawning, the ownership of the title plays a crucial role in securing a loan, and its eventual retrieval is dependent on specific conditions being met by the borrower.Conditions for Retrieving the Title

To retrieve a car’s title after a pawn transaction, a borrower must fulfill the terms of the loan agreement, which typically includes repaying the loan amount plus any applicable interest and fees. Most lenders require that the loan be paid within a specified time frame, often 15 to 30 days, and may offer the option of installment payments or a lump sum repayment.Ownership Status During the Loan

During the loan period, the borrower retains possession of the vehicle but not the title, which is held by the lender as collateral. The title remains with the lender until the loan and any additional charges are paid in full. Upon satisfactory repayment, ownership of the title reverts to the borrower, legally confirming their ownership of the vehicle.Default and Repossession

When a borrower fails to meet the loan obligations for a car title pawn, it inevitably leads to default, which may result in the vehicle’s repossession as a means to recover the lender’s money.Consequences of Defaulting

Defaulting on a car title pawn means the borrower has not upheld their end of the loan agreement, usually by failing to make timely payments. This triggers several negative outcomes, including additional penalties and fees, a substantial dip in credit score, and the potential loss of the vehicle which is used as collateral for the loan. Lenders are legally permitted to take possession of the vehicle to repay the loan’s balance.Repossession Process

Once a borrower defaults, the repossession process begins. The lender may offer a short grace period to resolve the debt, but if no agreement is made, they will proceed to seize the vehicle. After repossession, procedures vary by state, but typically, the lender will notify the borrower that the vehicle is scheduled to be sold at auction. The borrower often has the opportunity to redeem the vehicle by paying the total owed amount, including any additional fees incurred due to the default.Frequently Asked Questions

The following section addresses common inquiries about pawn car title loans, detailing specific requirements, operational procedures, interest rates, and the implications of using your vehicle as collateral.What are the requirements to pawn a car title?

To pawn a car title, typically, one must provide a free and clear vehicle title, government issued identification, and proof of income. The vehicle must be owned outright, without any existing liens or loans against it.How do car title loans work at pawn shops?

Car title loans at pawn shops operate by offering a percentage of the car’s assessed value in the form of a loan. The car title is used as collateral until the loan, plus interest, is repaid.What are the typical interest rates for pawn car title loans?

Interest rates for pawn car title loans can vary widely, often depending on the state and lender. They can be quite high, significantly higher than traditional bank loans, and may cause the loan to be costly over time.Can I still drive my vehicle if I take out a pawn car title loan?

Yes, you can still drive your vehicle if you take out a pawn car title loan. The lender holds onto the title as collateral, but you retain the use of your car while you are repaying the loan.Are there risks involved with using a car title as collateral for a loan?

There are risks involved when using a car title as collateral. If the loan cannot be repaid, you risk losing your vehicle to the lender, and the loan can also accrue high interest rates which may lead to financial strain.How does the repayment process work for car title loans?

The repayment process for car title loans typically involves monthly payments that cover both principal and interest. The details of the repayment plan should be clearly defined in the loan agreement, and can vary with different pawnshop policies. Failure to repay can result in the repossession of the vehicle.We are not the lenders, so we can not guarantee you will get a cash loan. Your lender can fund your loan as soon as the next business day. We do offer an online form to see if you can get a quick cash loan for your car.Jer is a Consultant & go-to guy for startups and founders. Expert with both Online and storefront B2C lending strategies. Jer at Trihouse Consulting is your Co-Founder, consultant, investor... Start-ups in installment, payday loan, car title lending, line of credit... Storefront to Online transition is my specialty. Focused on operations, marketing, Internet models, tribe, brick-n-mortar development, website development, regulatory & compliance, and State and Tribe licensed lending models. Banking, ODFI, ACH, ICL, Debit, Credit.

TrihouseConsulting@gmail.com 702-208-6736 (PDT)

Linked In profile

Mentioned in Digital Groth

Clarity FM

Trihouse Consulting

How to start a payday loan

zoom info

Startups.com

IWV Pro

Leaning Rock Finance

payday and paycheck loans

Automobile Pawn

Quora

Medium

RocketReach